Malaysia is a beautiful and diverse country with many aspects in Southeast Asia Region with own characteristic features make this country great. The country has developed itself enormously in the past 60 years since independent and this is clearly noticeable in the world economic stand.

Former Malaysian Prime Minister Najib Razak announced GST of 6% effective on 1 April 2015. It has absolutely replaced the Sales and Services Tax which been used in the country for several decades. The Najib Razak administration was seeking additional revenue to offset its budget deficit and reduce its dependence on revenue from Petronas, Malaysia’s state-owned oil company. The 6% tax will replace a sales-and-service tax of between 5–15%. The Goods and Services Tax (GST) is a value added tax in Malaysia. GST is levied on most transactions in the production process, but is refunded with exception of Blocked Input Tax, to all parties in the chain of production other than the final consumer

Implementing GST tax is part of any Government to enhance the capability, effectiveness and transparency of tax administration of the existing taxation system. GST is capable of generating a more stable source of revenue to the nation because it is less susceptible to economic fluctuations. Various benefits that GST can offer to Malaysian consumers and businesses are the revenue from GST for development purposes for social infrastructure like health facilities and institutions, educational infrastructures, public facilities, nation-building projects for progress towards achieving a high-income nation.

Unfortunately, Malaysians seems does not enjoy any of those benefits from GST revenue. Approximate amount of GST collected in 2015 was RM27 billion or 12.3 % of the government’s overall revenue of RM219.1 billion, In 2016 was RM 41. 2 billion or 19.4 % of the RM212.4 billion government revenue. In 2017, Najib Razak’s administration collected RM41.5 billion contribute 18.4 % to the RM225.3 billion government revenue. Total sum GST reaches RM1.1 trillion. According to the Economic Report 2017/18, total of 454,609 business entities have registered under the GST whereby the bulk of the registrants are in wholesale, retail trade, repair of motor vehicles. The motorcycle vehicle sector accounted for 34.2 % of the total, followed by construction (17.7 %) and manufacturing (12.4 %) sectors.

Comparing the increase of the National Debts since implementation of GST. This is the gross government debt, this means the amount of money (the repayment value) owed by government. RM630.5bil, representing 54.4% of gross domestic product (GDP), as at December 2015. In year 2016, RM648.475 billion increase of RM 17.935. In year of 2017, RM 663.4 billion. External Debt in Malaysia increased to RM 893408.61 Million in the first quarter of 2018 from RM 883368.20 Million in the fourth quarter of 2017. External Debt in Malaysia averaged RM 229391.83 Million from 1990 until 2018, reaching all time high of RM 908704.13 Million in the fourth quarter of 2016 and a record low of RM9063 Million in the second quarter of 1997. Interest per Year RM 23,408,447,239- Debt per Citizen RM 20,080.

Malaysia – Economic Indicators

| GDP Growth Rate | 1.4 % | Mar/18 | 1 | -5.9 : 5.5 | Quarterly |

| Unemployment Rate | 3.3 % | Mar/18 | 3.3 | 2.7 : 4.5 | Monthly |

| Inflation Rate | 1.3 % | Mar/18 | 1.4 | -2.4 : 23.9 | Monthly |

| Interest Rate | 3.25 % | May/18 | 3.25 | 2 : 3.5 | Daily |

| Balance of Trade | 14688 MYR Mil | Mar/18 | 9018 | -2881 : 15767 | Monthly |

| Government Debt to GDP | 50.9 % | Dec/17 | 52.7 | 31.8 : 80.74 | Yearly |

source : tradingeconomics

There are several reasons why prices had surged after the implementation of GST in Malaysia. It could have been due to poor enforcement on prices. Another reason could be the delays in the refund of the input tax by the Customs Department to the business owners. Business owner may have decided to pass on their costs to consumers by raising prices to quick cover of the cost price and sustain business revenue. In GST system, businesses had to fork out the tax payments upfront, and wait for the Customs Department to refund them with the input tax. As a result, on top of the 6% GST, consumers also saw the base price of goods and services increasing.

Can Malaysia sustain without GST ? Yes, definitely possible. Our country survived and economically stabilized by collecting Service and Sales Tax (SST) since 1970s. There many factors are involved to make Malaysia High-Income State. Expenditure reduction will begin with rationalisation, efficiency measures and reduction in wastages. Practice good governance with accountability, more Foreign Direct Investment – FDI to increase revenue/GDP of the state. According to the central bank of Malaysia, domestic demand will continue to drive growth, supported by favourable earnings and employment conditions, as well as new and ongoing infrastructure projects and capital expenditure.

A government can influence the rate of economic growth by; Expansionary fiscal policy– cutting taxes to increase disposable income and encourage spending. However, lower taxes will increase the budget deficit and will lead to higher borrowing. The expansionary fiscal policy is most appropriate in a recession when there is fall in consumer spending. Expansionary monetary policy– cutting interest rates can boost domestic demand. A key function of the government is to provide Economic and political stability which enables the usual economic activity to take place. Uncertainty and political tension can discourage investment and economic growth. Investment in infrastructure– increases productive capacity and reduces congestion especially urban planning in Urban, Suburban and small towns. Privatisation and deregulation – increase efficiency and productivity.

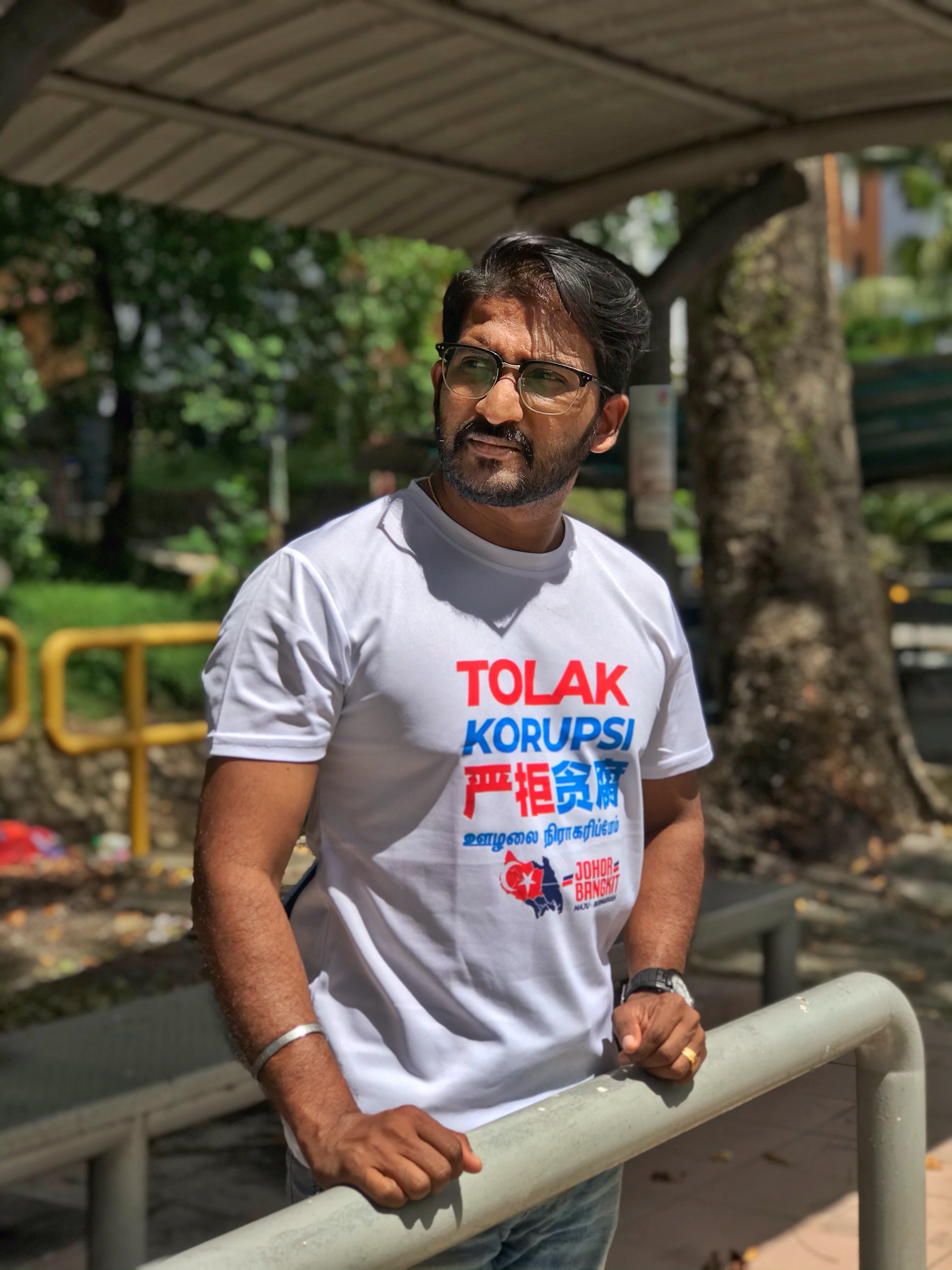

I hope The new Pakatan Harapan Government lead by Tun Dr. Mahathir will ensure that 0% of the Goods and Services Tax (GST) from 1 June 2018 will ease the burden of the common people without worsening current economic crisis. May Glorious days of Malaysia will be back sooner.